September 2025 Global Electronics Industry Monthly Report: Global Competition in Technological Breakthroughs and Ecosystem Restructuring

When the laser-welded VC vapor chamber cooling system of Apple's iPhone 17 Pro meets Samsung's upcoming tri-fold display prototype, when NVIDIA Blackwell architecture GPUs compete head-to-head with Meta's self-developed AI chips, and when the monopoly of TSMC's CoWoS packaging technology faces the restructuring of the global supply chain — the electronics industry in the golden autumn of 2025 is staging a technological symphony spanning three continents. This global industrial revolution, encompassing consumer terminals, computing infrastructure, and semiconductor fundamentals, not only redefines the form of next-generation technology products but also reshapes the power structure of the global industrial chain.

Consumer Electronics: A Global Race for Form Innovation and Ecosystem Competition

Apple's iPhone 17 Pro series, launched on September 10, has elevated mobile computing capabilities to new heights. Equipped with the A19 Pro chip — the first in Apple's lineup to support local operation of large language models — and paired with an 8x optical zoom camera, it transforms smartphones into true mobile AI workstations. The most notable technological breakthrough lies in the ultra-ceramic crystal panel adopted for the device body. Through nanoscale crystal restructuring technology, its scratch resistance has been enhanced by 3 times compared to the previous generation, addressing a long-standing pain point for high-end device users. The innovation in the cooling system is equally crucial: the laser-welded VC vapor chamber increases heat transfer efficiency by 40%, providing stable support for sustained high-load operations.

The foldable display sector is witnessing full-scale competition among global giants. Roh Tae-moon, head of Samsung Electronics' Device eXperience division, recently announced that the company's first tri-fold smartphone has entered the "final stage" of development and is scheduled for release before the end of this year. This move marks the official bet of leading global manufacturers on next-generation form innovation, creating direct competition with the Huawei Mate XTs Ultimate. Leveraging its tri-fold design and HarmonyOS 5.1 ecosystem, Huawei has captured 75% of the Chinese market with cumulative shipments exceeding 10 million units. However, Samsung, with its global channel advantages and supply chain integration capabilities, is expected to gain a competitive edge through differentiation in the international market.

The global foldable display market is maturing at an accelerated pace. IDC predicts that shipments will surpass 50 million units in 2025. Driven by technological breakthroughs such as the mass production of UTG (Ultra-Thin Glass), the cost of key components has dropped by more than 30%, promoting the transition of foldable devices from high-end niche products to mass-market offerings. Apple's planned launch of its first foldable iPhone in 2026 will further ignite market enthusiasm, driving global supply chain enterprises such as Foxconn and Luxshare Precision into a fast-growth trajectory.

Innovations in display technology are developing in a diversified manner. At the AWE 2025 exhibition, Samsung showcased its transparent MICRO LED technology, which uses a transparent cubic design to demonstrate the "disappearing screen," redefining the relationship between display devices and space. Its flagship Neo QLED 8K QN950F TV is equipped with the NQ8 AI Gen3 chip, which has 768 neural networks — enabling a comprehensive upgrade of AI Image Enhancement Pro. Meanwhile, Samsung's OLED series has obtained Pantone Color Certification, highlighting the pursuit of ultimate color reproduction in display technology.

AI Computing Revolution: Global Competition in End-Cloud Collaboration and Chip Self-Development

End-side AI devices are approaching a global explosion point. Under Samsung's "AI for All" vision, its smart home ecosystem achieves interconnection between devices through the SmartThings platform, creating a new lifestyle of "SmartThings meets AI Home." The 9 Series AI Refrigerator is equipped with a 9-inch smart control screen and Bixby voice assistant, utilizing AI hybrid cooling technology to dynamically adjust temperature control. The newly added AI food recognition function automatically manages food items and provides customized services, demonstrating the in-depth penetration of AI in household scenarios.

Competition in cloud-side computing has entered a new phase of "chip self-development." At CES 2025, NVIDIA released the RTX 50 series graphics cards based on the Blackwell architecture. The high-end RTX 5090 model features 9.2 billion transistors, delivering 3,400 TOPS of computing power, with a price tag of $1,999. More strategically significant is its planned development of the Grace Blackwell NVLink72 super chip, which will use 72 Blackwell GPUs to provide a new solution for large-scale AI training. AMD simultaneously launched the Ryzen AI series processors, targeting the enterprise-level AI PC replacement cycle and creating direct competition with NVIDIA.

The trend of chip self-development among internet giants is reshaping the computing landscape. Meta's first self-developed AI training chip, MTIA, has completed testing and offers 50% higher energy efficiency than current mainstream GPUs. Meta plans to fully replace externally purchased chips with MTIA by 2026, marking a deeper phase in tech giants' efforts to control computing costs. This trend of vertical integration is spreading globally — from Silicon Valley in the United States to Shenzhen in China, tech companies are competing to build technological barriers through chip self-development.

Memory chips have become the "strategic mineral" of the AI era. The demand for high-bandwidth memory (HBM) from large AI models has driven the HBM market to achieve a year-on-year growth of 120%. This memory solution, which integrates multiple DRAM chips through 3D stacking technology, can provide a 1024-bit interface width and TB-level bandwidth, building a "highway" for data transmission. While Samsung and SK Hynix accelerate the development of HBM4, breakthroughs in advanced packaging by enterprises such as Jiangsu Changjiang Electronics Technology (JCET) have led to a diversified distribution of the global supply chain.

Semiconductor Industry: Global Supply Chain Restructuring Amid Monopoly and Breakthroughs

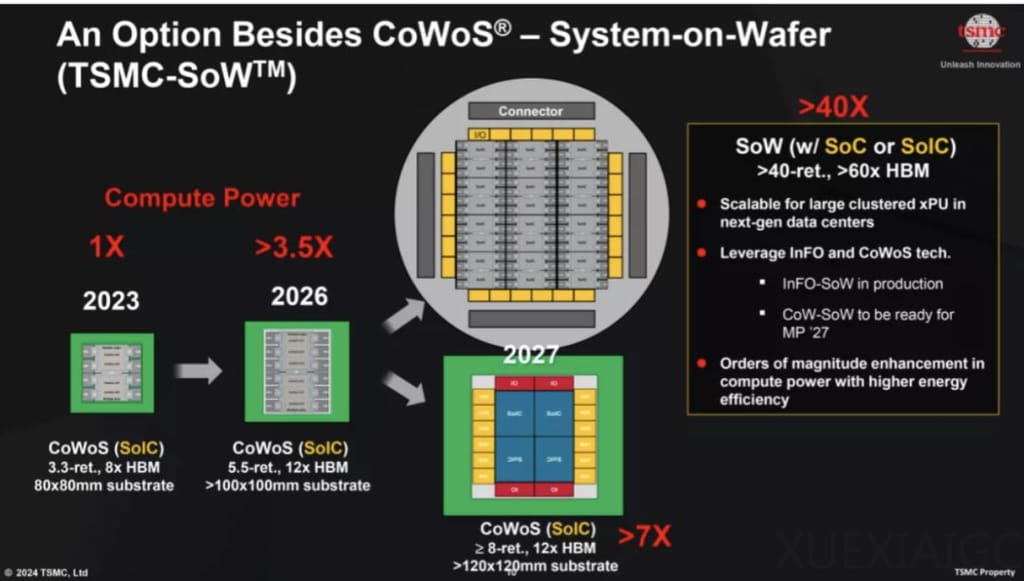

The wafer foundry market presents a pattern of "high-end concentration and mid-end dispersion." According to TrendForce data, TSMC's revenue reached \(30.24 billion in the second quarter of 2025, maintaining its leading position with a 70.2% market share. Its CoWoS advanced packaging technology dominates the AI chip foundry market, with monthly revenue hitting record highs for six consecutive months. Samsung's second-quarter revenue reached nearly \)3.16 billion, ranking second with a 7.3% market share — however, its market share declined by 0.4 percentage points month-on-month, reflecting the fierce competition in high-end manufacturing processes.

Geopolitical factors are driving the regionalization of the supply chain. SMIC (Semiconductor Manufacturing International Corporation) has achieved an over 90% capacity utilization rate for its 28nm process and a 90% yield rate for its 14nm process. Orders for mature processes have been scheduled until the second quarter of 2026, indicating a trend toward diversified distribution of global semiconductor manufacturing capabilities. Equipment from enterprises such as NAURA and AMEC has entered the verification phase, increasing the localization rate of China's semiconductor equipment from 15% in 2020 to 38% currently. This regional breakthrough is changing the pattern of the global equipment market.

The localization process in the EDA (Electronic Design Automation) tool sector is accelerating. Against the backdrop of U.S. export restrictions, tools developed by enterprises such as Huada 九天 (Huada Jiutian) and GaiLun Electronics have achieved substitution. The domestic EDA market in China grew by 45% year-on-year in the second quarter of 2025. This localization of the full-process tool chain not only ensures supply chain security but also promotes diversified competition in the global EDA market.

Policy and Green Transformation: Global Consensus on Sustainable Development

Global policy frameworks are shaping the development direction of the electronics industry. The EU's "New Battery Regulation" officially took effect in 2025, requiring a 60% reduction in battery carbon footprints by 2030 compared to 2020 and promoting the establishment of sustainable development standards across the industry. The Advanced Manufacturing Tax Credit under the U.S. "Clean Energy Act" provides a maximum 25% investment tax rebate for semiconductor and electronics manufacturing enterprises, stimulating domestic capacity expansion. China's Ministry of Industry and Information Technology's "2025-2026 Steady Growth Action Plan for the Electronic Information Manufacturing Industry" focuses on new areas such as AI terminals and smart cars, aiming to achieve an average annual revenue growth of over 5% by 2026.

Green manufacturing has become a core competitiveness for enterprises. Samsung incorporates energy-saving concepts into product design: its Vision AI TV features Smart Sound AVA Pro and adaptive volume adjustment functions, enhancing user experience while reducing energy consumption. GEM Co., Ltd. has built the world's largest power battery recycling base, achieving a recovery rate of over 98% for nickel, cobalt, and manganese. The "targeted restoration" technology developed by Bangpu Recycling reduces the cost of battery material recycling by 40%. These practices are reshaping the value distribution of the new energy industrial chain.

Conclusion: Technological Breakthroughs Amid Global Collaboration

In September 2025, the global electronics industry stands at a crossroads of technological breakthroughs and geopolitical restructuring. From terminal innovation by Apple and Samsung to computing competition between NVIDIA and Meta, and from the manufacturing pattern of TSMC and SMIC — technological iteration and supply chain security have become dual priorities for global enterprises.

For international trade practitioners, three key trends deserve attention: the global layout of AI computing infrastructure (supply chains of NVIDIA and Meta), the demand for components driven by the maturity of the foldable display ecosystem (UTG glass, precision hinges), and material innovation under sustainable manufacturing standards (battery recycling, low-carbon manufacturing processes). In this new era of intertwined technology and policy, the key to success lies in understanding the characteristics of regional markets while seizing opportunities for global technological collaboration.

This cross-border technological competition is no longer a zero-sum game but a complex chess game of seeking collaboration amid competition. As demonstrated by Samsung's "One Samsung" philosophy, the future electronics industry will be an organic combination of technological innovation and ecosystem collaboration, finding a new balance between globalization and regionalization.

Need Help?

Need Help?