2026 Semiconductor Industry: Key Trends, Breakthroughs and Global Layouts

As we step into 2026, the global semiconductor, chip and electronic component industry has officially entered a super cycle driven by artificial intelligence (AI) computing power. With the global chip market expected to surpass $1 trillion for the first time this year, coupled with continuous technological breakthroughs, drastic market changes and accelerated restructuring of the global industrial chain, the industry is showing an unprecedented booming momentum. This article sorts out the major events and core trends of the industry in 2026 so far, providing valuable references for global partners in the foreign trade field.

I. Technological Breakthroughs: Paving the Way for the Next-Generation Semiconductor Era

Technological innovation has always been the core driving force of the semiconductor industry. In 2026, major breakthroughs have been made in materials, equipment and packaging technologies, breaking through long-standing technical bottlenecks and opening up new development paths.

1. World’s First Wafer-Scale Bismuth-Based Ferroelectric Transistor

On February 9, Professor Peng Hailin’s team from Peking University published a landmark achievement in Science, developing the world’s first wafer-scale ultra-thin and uniform new bismuth-based two-dimensional ferroelectric oxide. The transistor operates at an ultra-low voltage of only 0.8V and has a durability of 1.5×10¹² cycles, comprehensively surpassing the industrial-grade hafnium-based ferroelectric system currently in use. This breakthrough provides a new solution for AI chips to break through the "power wall", which can greatly improve energy efficiency and extend the battery life of smart devices. At present, a high-performance ferroelectric transistor array has been prepared, showing broad industrialization potential.

2. Domestic Etching Machine Passes Mass Production Verification

On February 4, China Microelectronics’ Primodc-R etching machine successfully passed the mass production verification of Yangtze Memory Technologies Co., Ltd. (YMTC) for 232-layer 3D NAND manufacturing. Compared with international similar products, the etching rate of this equipment is increased by 20%, and the uniformity is controlled within ±3%. More importantly, the localization rate of its core components has reached 70%, marking a major breakthrough in China’s key equipment field of memory chips and accelerating the process of domestic substitution of semiconductor equipment.

II. Market Dynamics: Memory Chip Prices Soar, Market Scale Hits a New High

Driven by the explosive growth of AI demand, the global semiconductor market in 2026 has shown a strong growth momentum, with drastic changes in product prices and a continuous expansion of market scale, becoming the focus of the global industry.

1. Memory Chip Prices Surge to a Historical High

According to the latest report from TrendForce, the contract price of standard DRAM in the first quarter of 2026 increased by 90%-95% month-on-month, and some spot prices even soared by 170%; the contract price of NAND Flash increased by 55%-60% month-on-month, and the price of high-end SSDs rose more significantly. Counterpoint’s data also shows that in February, the price of memory chips rose by 80%-90% month-on-month, setting a historical record. The main driving force behind this round of price surge is the explosive demand for AI servers, coupled with the production reduction of major manufacturers, leading to an imbalance between supply and demand in the market.

2. Major Chip Manufacturers Announce Price Increases

Faced with the dual pressure of rising costs and tight supply, many leading chip manufacturers have successively announced price increases in February 2026. Infineon Technologies announced that it will increase the price of power switches and related chips by 8%-12%, which will take effect on March 1. Samsung Foundry plans to increase the price of 4nm and 8nm processes by about 10% due to the tight production capacity caused by the surge in AI chip demand. Intel predicts that the shortage of memory chips will continue until 2028, and at the same time announced its entry into the GPU market to enhance its competitiveness in the AI semiconductor field.

III. Enterprise Strategies: Global Layout Adjustment, Intensified Competition

In 2026, major global semiconductor enterprises have accelerated their strategic layout adjustments, focusing on advanced processes, AI chips and new energy-related semiconductor fields, and carrying out a series of mergers, acquisitions and cooperation to enhance their core competitiveness.

1. TSMC Upgrades Japan Kumamoto Plant to 3nm Process

On February 7, TSMC announced a major upgrade to its second Kumamoto plant in Japan—skipping mature 6-12nm processes and directly mass-producing 3nm chips, focusing on high-end fields such as AI data centers, autonomous driving and robotics. The total investment of the plant has soared from $12.2 billion to $17 billion. The Japanese government has approved a subsidy of 732 billion yen (about $4.8 billion) and plans to provide additional support. More than 50 Japanese enterprises including Sony and Toyota have participated in the investment and construction. This upgrade marks that Japan has obtained 3nm manufacturing capacity for the first time. It is expected to achieve a monthly production scale of 50,000 wafers by 2028, accounting for 30% of the global 3nm chip production capacity, which will have a profound impact on the global advanced process pattern.

2. STMicroelectronics Signs Multi-Billion Dollar Long-Term Cooperation with AWS

On February 9, STMicroelectronics (STMicro) announced a long-term strategic cooperation with Amazon Web Services (AWS) with a scale of billions of US dollars. Under the cooperation, STMicro will become the core supplier of AWS advanced semiconductors, providing high-performance mixed-signal processing chips, microcontrollers (MCUs) and analog and power ICs. The two parties will jointly optimize the cloud-based EDA process, use AWS computing power to accelerate the iteration of chip design and shorten the time-to-market of new products. In addition, STMicro will issue up to 24 million shares to AWS, establishing a deep binding cooperative relationship to jointly seize the development opportunities brought by the AI era.

3. Samsung Accelerates Mass Production of HBM4

On February 10, Samsung Electronics announced that it will accelerate the mass production process of HBM4 (High Bandwidth Memory 4), and is expected to start mass production as early as the third week of February. The single HBM4 chip has a capacity of 288GB and a bandwidth of 22TB/s, which can perfectly adapt to NVIDIA’s next-generation AI computing platform (Vera Rubin). Large-scale commercial shipments are planned to start in mid-May. SK Hynix is also advancing the R&D of HBM4 simultaneously, launching a fierce competition with Samsung, which will break the previous "monopoly" pattern of HBM supply and help NVIDIA realize the diversification of suppliers, thereby alleviating the supply pressure of high-end AI chips.

IV. Policy Updates: Global Governments Strengthen Semiconductor Industry Support

In 2026, governments of various countries have further increased their policy support for the semiconductor industry, focusing on building a localized industrial ecosystem and accelerating the process of independent R&D and manufacturing, so as to enhance their core competitiveness in the global semiconductor industry.

1. India Releases ISM 2.0 Plan

On February 7, the Indian government officially released the ISM 2.0 (India Semiconductor Mission 2.0) plan, focusing on the local design and manufacturing of the semiconductor ecosystem, with key support for the equipment and materials fields. The plan clearly proposes the development goal of achieving 70-75% independent design and manufacturing capacity of domestic application chips by 2029, and formulates a detailed roadmap for 3nm and 2nm technology nodes, aiming to become one of the world’s top five semiconductor countries by 2035.

2. EU NanoIC Production Line Officially Put into Use

On February 9, the EU’s NanoIC production line, a core pilot project of the EU Chip Act, was officially put into use in Leuven, Belgium. With a total investment of 2.5 billion euros, the production line focuses on the development of advanced semiconductor technologies in the post-2nm era, aiming to help the EU seize 20% of the global semiconductor production capacity by 2030 and form a "tripartite confrontation" pattern with the United States and Asia in the global semiconductor industry.

V. 2026 Full-Year Industry Trend Outlook

Looking forward to the whole year of 2026, the global semiconductor industry will continue to maintain a booming development trend, with several core trends worthy of attention from global foreign trade partners.

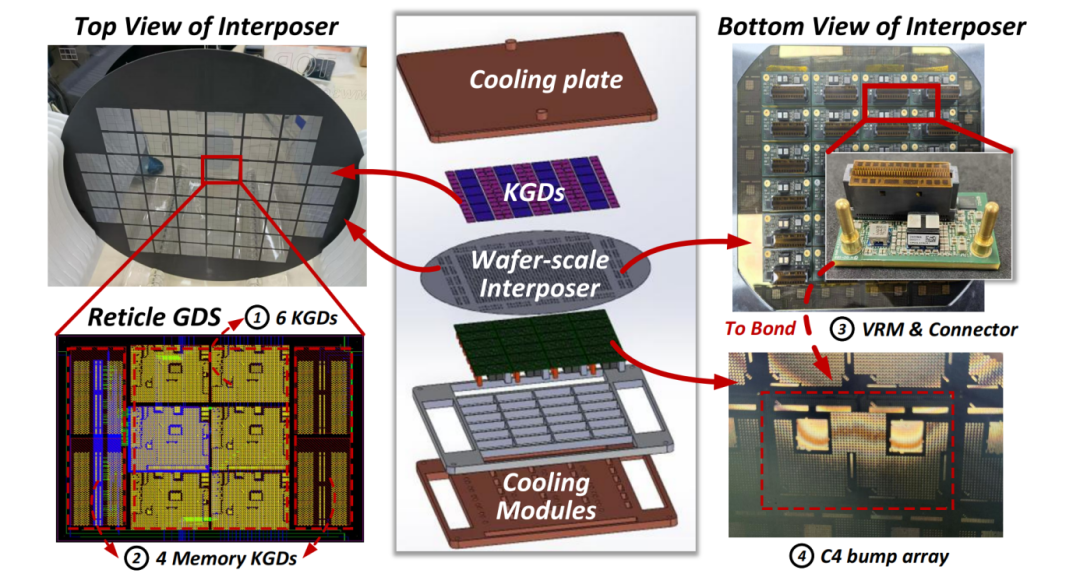

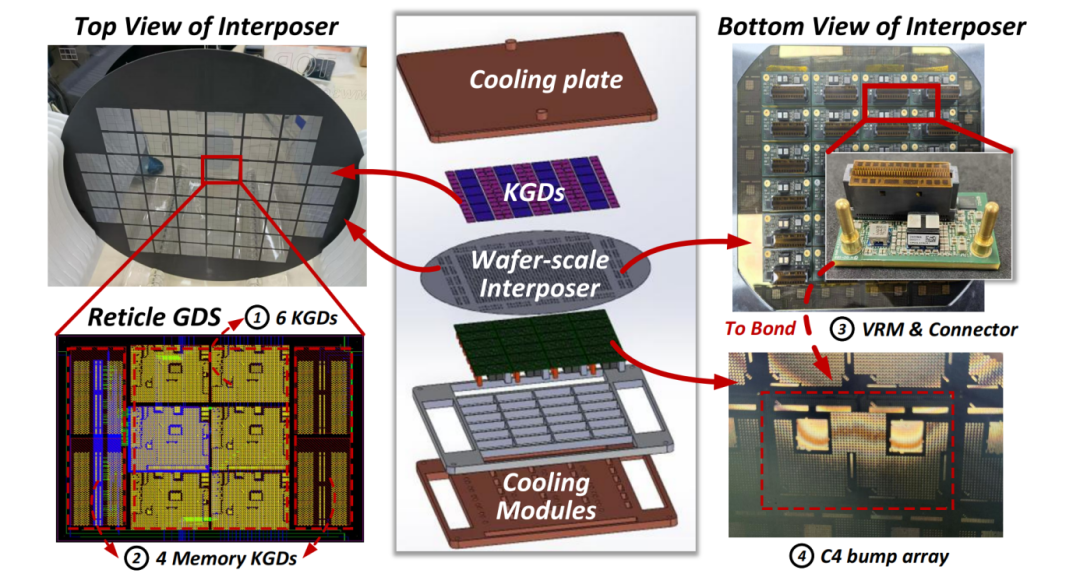

First, the competition in advanced processes will become increasingly fierce. TSMC will fully launch 2nm technology, Samsung will accelerate the expansion of 3nm production capacity, Intel will catch up with its Intel 18A process, and Japan will officially enter the 3nm era, making the global advanced process enter a "three-way competition" stage. Second, AI computing power will drive a memory revolution. 2026 will be the first year of commercialization of 3D DRAM, DDR6 will enter the testing phase, and its performance will be improved by 2-3 times, supporting the deployment of local large models on the terminal side. Third, Chiplet and advanced packaging will become the standard configuration. The industry will shift from transistor miniaturization to "system-level collaborative design" and "heterogeneous integration" to solve the "warpage wall" and "power wall" problems of AI chips. Fourth, compound semiconductors such as SiC and GaN will experience explosive growth. The global SiC market scale will exceed $5 billion in 2026, with a compound annual growth rate of more than 30%, and the demand in new energy vehicles and photovoltaic fields will surge. Fifth, the restructuring of the global industrial chain will accelerate. Regional layout will become the mainstream, and countries around the world will build their own industrial ecosystems while strengthening cross-regional cooperation, making supply chain flexibility the core competitiveness. Sixth, China’s semiconductor localization process will accelerate. The mass production and delivery of 28nm lithography machines, the improvement of the localization rate of key equipment, the breakthrough of advanced packaging technologies, and the substantial progress in the localization of memory chips will inject new vitality into the global semiconductor industry.

Conclusion

2026 is the first year of the global semiconductor industry entering a "super cycle". The explosive growth of AI computing power has become the core driving force, and the global chip market is expected to break through the $1 trillion mark for the first time. Technically, the industry is moving towards collaborative innovation of new materials, new structures and new packaging; in the market, memory chip prices have soared to a historical high, and HBM4 has become a new battlefield for the AI arms race; in terms of the industrial pattern, major global enterprises are adjusting their strategic layouts, and governments of various countries are increasing policy support. For global foreign trade partners, grasping these core trends and major events will help to accurately judge market opportunities and achieve win-win cooperation in the fierce market competition. We will continue to pay attention to the latest dynamics of the semiconductor industry and provide timely and valuable industry information for global partners.

Need Help?

Need Help?